Rethinking Retirement: Why Time Is the Real Goal

In my 11 years working inside the banking and financial planning industry, I noticed a recurring challenge for most advisors: trying to engage clients between 35 and 45 years old in conversations about “retirement” savings—especially those in the thick of raising a family.

For many, the idea of putting money aside today for something 20 or 30 years in the future felt totally disconnected from their current reality. Clients knew they should save for retirement—but it wasn’t a goal that energized them. It felt like an obligation. A checkmark on a financial to-do list.

Even when we explained the tax advantages of RRSPs or group plans and showed the miracle of compounding returns, the emotional connection just wasn’t there. Sure, they’d contribute. But for most, it felt like a duty—not a decision that excited or inspired them.

These were clients juggling demanding jobs, after-school activities, daycare bills, debt, mortgages, and aging parents. In that context, “retirement” sounded like a luxury—or worse, a vague promise backed by a fancy chart and some assumed rate of return.

The unspoken plan? Contribute something. Don’t touch it. Check in every few years. Hope it works out.

But here’s the truth: life doesn’t work that way. And the first time life throws a punch—a job loss, a family emergency, a big decision—those long-term plans get derailed. That “retirement account” becomes an emergency fund. And just like that, the vision disappears.

What Worked Instead? Reframing the Goal.

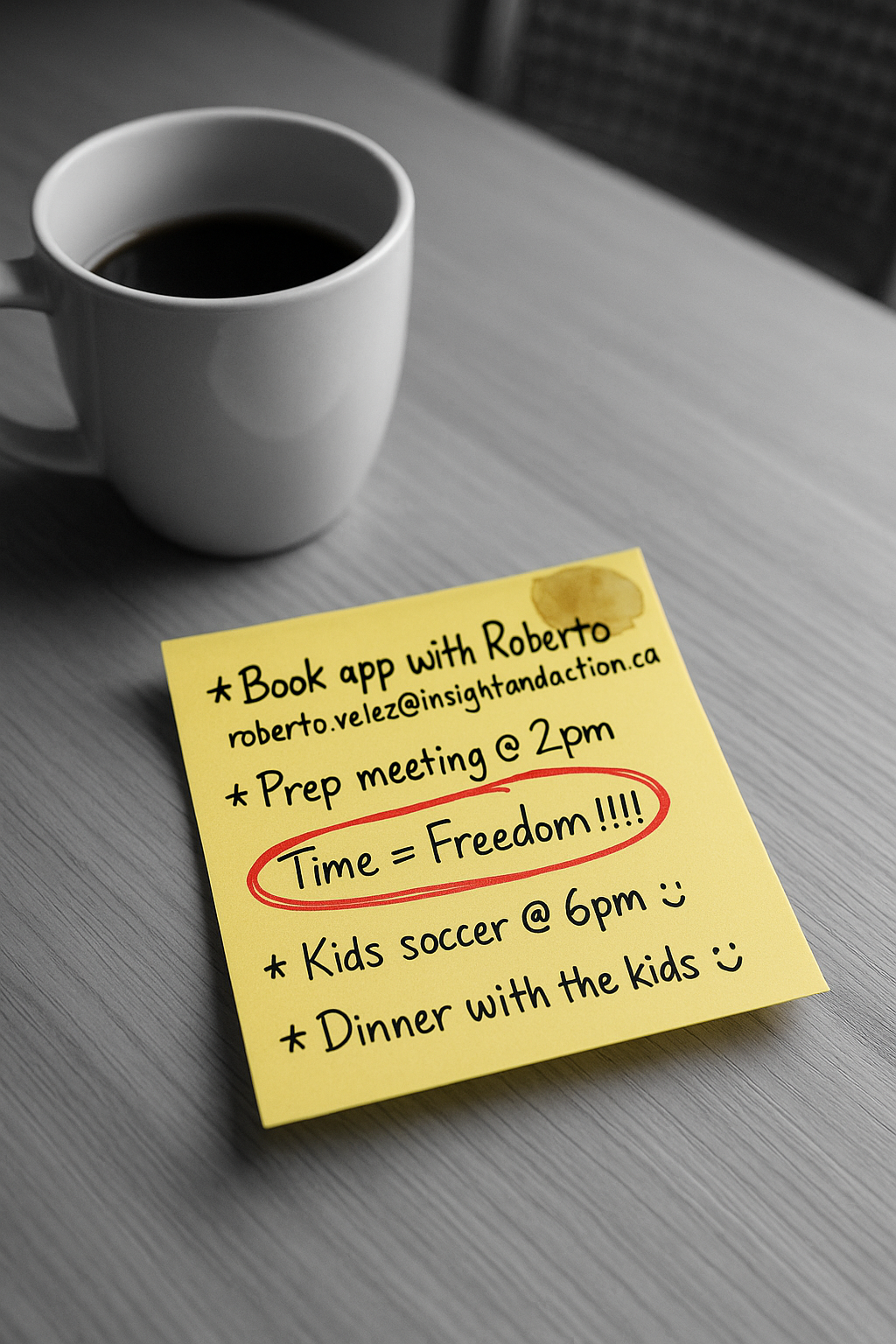

I stopped selling retirement as a destination. I started coaching people toward something more relevant—time.

Because that’s what we’re really trying to buy, isn’t it?

Not just security. Not just assets.

Time.

Time to do what we love.

Time to be with who matters.

Time to rest, pivot, heal, grow, explore.

Retirement is just one version of time. But time isn’t attached to a date. It’s built through decisions we make today—decisions that reflect our values, energy, and priorities.

And when clients realize that what they’re actually planning for is time freedom, their mindset changes.

Financial literacy rises.

Cash management, RRSPs, TFSAs, RESPs, MERs, trailer fees, robo-advisors—they stop sounding like jargon and start looking like tools.

Tools to buy back the most precious currency we have: our time.

What Functional Medicine Taught Me About Financial Planning

With its pros and cons, followers and critics, the concept of functional medicine has reshaped my thinking and approach to financial planning.

I am a firm believer that just like health, financial well-being deserves a model that looks beyond symptoms. One that focuses on root causes and treats the person—not just the problem.

Functional medicine doesn’t treat symptoms in isolation. It doesn’t say, “Here’s a pill for your pain” and send you on your way.

Instead, it asks deeper questions:

It sees the human body as an interconnected whole—and focuses on personalized, long-term, relationship-based care.

When I discovered this approach, I saw the clear parallels to financial planning.

Because just like our health, our financial lives aren’t isolated or simplistic.

They’re complex. Interconnected. Emotional. Behavioral. And most importantly, deeply personal.

What If Financial Planning Worked Like That?

That’s what functional financial planning is all about.

It’s about asking:

Why are you stressed about money?

What’s really holding you back?

What’s the system of habits, pressures, and decisions that need realignment?

This model shifts everything:

✅ The client becomes the center

✅ The goal becomes freedom and clarity—not retirement

✅ The process becomes collaborative and educational—not sales-focused

And instead of checking in once a year to rebalance your portfolio, we’re having real conversations about your life—and how your money fits into it.

This is where true transformation happens.

Final Thoughts: Redefining Planning for Real Life

The world has changed. Our lives are busier, more complex, and more uncertain than ever. The way we plan for our future needs to reflect that.

“Retirement” doesn’t motivate most people anymore—not because they don’t care about their future, but because they care deeply about their present, too.

They want to build lives that make sense today and tomorrow.

To understand how money can serve their values—not just their account balance.

Functional financial planning isn’t about abandoning retirement. It’s about redefining what financial success looks like—for real people, with real lives, and real priorities.

It’s about designing a life worth living—now and later.

That’s the kind of planning people deserve.

And it’s the kind of planning I’m committed to delivering.

Let’s be clear: strategy and financial planning do not require large balances to invest.

Real planning starts with intention, not assets.

We live in an incredible era where financial institutions have created powerful products—and we are privileged to be in a marketplace where competition and technology have leveled the playing field.

My job isn’t to push a product.

It’s to help you choose the right mix of tools that align with your goals, values, and functional financial plan.

Together, we’ll evaluate which institutions and solutions support your strategy—not the other way around.

Because in this model, you choose the investment.

Not the investment choosing you.

Ready to Redesign Your Financial Plan Around Your Life?

If this message resonates with you—if you’re tired of product pitches and want a financial plan built around your real life—I’d love to help.

📞 Book a free discovery call. Let’s talk about what freedom means to you—and how we can start building it now, not later.

📍 Based in Niagara, serving clients across Ontario.

🔗 Visit insightandaction.ca or connect with me on LinkedIn

Let’s build your plan around your time, your values, and your future—on your terms.